United States

highlights of operations

Chevron Corporation’s global headquarters are located in San Ramon, California – we are the second-largest integrated energy company headquartered in the United States. Through our subsidiaries and affiliates, Chevron produces crude oil, natural gas and many other essential products.

With our business and social investments, we boost economies in the areas where we operate by creating jobs, improving livelihoods and supporting local businesses.

Our products are sold in the more than 8,000 Chevron® and Texaco® retail stations across the United States. We are also a major supplier of aviation fuel in the country.

Chevron’s five U.S. refineries have the combined capacity to process more than 1.0 million barrels of oil per day.

Here are some other highlights of our U.S. operations:

- In 2020, Chevron was one of the largest liquids producers.

- In 2020, Chevron was one of the top producers of net oil-equivalent in California.

- Chevron is one of the largest net acreage leaseholders and producers in the Permian Basin.

- We are a leading developer, manufacturer and marketer of lubricant and fuel oil additives.

- Chevron is a leading premium base oil producer.

- Our Chevron Shipping Co. operates a fleet of crude tankers, product carriers and liquefied natural gas (LNG) carriers.

- Through our 50 percent ownership of Chevron Phillips Chemical Company LLC and its affiliates, we’re one of the world’s leading producers of chemicals and plastics.

business portfolio

exploration and production

Using the latest technology, Chevron continues to make major discoveries in the United States while maintaining strong production in mature fields.

Chevron is one of the largest hydrocarbon producers in the United States. In 2020, we produced an average of 1.06 million barrels of net oil-equivalent per day, 34 percent of the corporation’s worldwide total.

Our company’s major operations in the United States are primarily in the midcontinent region, the Gulf of Mexico and California.

At the end of 2020, Chevron was the second-largest leaseholder in the Gulf of Mexico.

Midcontinent

Chevron operates crude oil and natural gas fields in the midcontinental United States – primarily in Colorado, New Mexico and Texas. Chevron acquired Noble Energy, Inc. in October 2020. In 2020, the company’s net daily production from Chevron and Noble assets in these areas averaged 342,000 barrels of crude oil, 1,249 million cubic feet of natural gas and 179,000 barrels of natural gas liquids (NGLs).

Chevron is among the largest net acreage leaseholders and producers in the Permian Basin of West Texas and southeastern New Mexico. Operations in the Permian date to 1920, and total net production has surpassed 5 billion barrels of oil-equivalent. The Permian is composed of several basins, including the liquids-rich Midland and Delaware basins, and it offers opportunities for conventional resources as well as for shale and other tight resources. In the Midland and Delaware basins, horizontal drilling and multistage hydraulic fracturing yield considerable incremental potential. In the Central Basin Platform, we are maintaining production of these conventional resources through well workovers, artificial-lift techniques, facility and equipment optimization and enhanced recovery methods.

Chevron’s capital spending on exploration and development of our approximately 2.2 million net acres (8,903 sq km) of shale and other tight resources in the Midland and Delaware basins is focused on horizontal wells with multistage fracture stimulation.

Chevron follows a factory development strategy in the Permian Basin, which uses multiwell pads to drill a series of horizontal wells that are completed concurrently using hydraulic fracture stimulation. To increase performance, we also apply data analytics and technology.

Other midcontinent holdings include approximately 70,000 net acres (283 sq km) in the Haynesville Shale in East Texas. Low transportation cost and proximity to the Gulf Coast position the Haynesville resource as a competitive, reliable and long-term source of gas supply. The Noble acquisition also included 35,000 net acres (142 sq km) of mature assets in the Eagle Ford Shale in southern Texas.

Deepwater Gulf of Mexico

Chevron is one of the leading leaseholders in the deepwater Gulf of Mexico, with a long history of technical achievement and operational safety.

Average net daily production in 2020 was 175,000 barrels of crude oil, 96 million cubic feet of natural gas and 11,000 barrels of NGLs, primarily from the Jack/St. Malo and Tahiti fields, the Perdido Regional Development, and the Caesar/Tonga, Big Foot, Tubular Bells, Blind Faith and Mad Dog fields.

The Jack and St. Malo fields in the Walker Ridge area – in a water depth of 7,000 feet (2,134 m) – are being jointly developed with a host floating production unit centrally located between the two fields. Chevron has a 50 percent interest in the Jack Field and a 51 percent interest in the St. Malo Field and operates both. Production from the development is linked to the market by the Jack/St. Malo oil and gas export pipelines. Total net daily production in 2020 averaged 57,000 barrels of liquids and 9 million cubic feet of natural gas. Total potentially recoverable oil-equivalent resources are estimated to exceed 500 million barrels.

Also in Walker Ridge is the 60 percent-owned and operated Big Foot project. In 2020, net daily production averaged 14,000 barrels of liquids and 2 million cubic feet of natural gas. The project has an estimated production life of 35 years and total potentially recoverable oil-equivalent resources are estimated to exceed 200 million barrels.

In 2020, net daily production at the 58 percent-owned and operated Tahiti Field averaged 39,000 barrels of crude oil, 17 million cubic feet of natural gas and 2,000 barrels of NGLs. The Tahiti Field has an estimated remaining production life of more than 20 years.

Chevron has a 15.6 percent nonoperated working interest in the Mad Dog Field, where net daily production in 2020 averaged 9,000 barrels of liquids and 1 million cubic feet of natural gas. The Mad Dog 2 Project is developing the southwestern extension of the Mad Dog Field. The total potentially recoverable oil-equivalent resources for Mad Dog 2 are estimated to exceed 500 million barrels.

Stampede is a joint development of the Knotty Head and Pony fields, in Green Canyon. Chevron holds a 25 percent nonoperated working interest. The fields are in a water depth of 3,500 feet (1,067 m), with a reservoir depth of 30,000 feet (9,144 m). In 2020, total daily net production averaged 7,000 barrels of liquid and 2 million cubic feet of natural gas. The field has an estimated production life of 30 years.

The Anchor Field is in the Green Canyon area, approximately 140 miles (225 km) off the coast of Louisiana, in a water depth of approximately 5,000 feet (1,524 m). Chevron has a 75.4 percent interest in the Northern Unit area and a 62.9 percent working interest in the Southern Unit area. This project will utilize an ultra-deep water offshore drillship, capable of handling pressures of 20,000 psi, which also enables access to other high-pressure resource opportunities across the Gulf of Mexico. The total potentially recoverable oil-equivalent resources for Anchor are estimated to exceed 420 million barrels.

Chevron operates the 60-percent owned Ballymore Field in the Mississippi Canyon area, approximately 75 miles (120 km) off the coast of Louisiana and 3 miles (5 km) from Chevron’s Blind Faith Platform, in a water depth of 6,536 feet (1,992 m). Chevron also has a 40 percent nonoperated working interest in the Whale discovery in the Perdido area, located about 200 miles (322 km) southwest of Houston, Texas.

In 2020, the company participated in three deep-water wells: two exploration and one appraisal well. Chevron added 23 blocks in Gulf of Mexico lease sales totaling approximately 132,000 net acres in 2020.

Colorado

Chevron has 327,000 net acres (1,323 sq km) in Colorado’s DJ Basin with current development in two core areas: Wells Ranch and Mustang. Row development with integrated pipeline infrastructure in the Mustang area improves both cycle times and capital efficiency. In 2020, net daily oil-equivalent production was 148,000 barrels, composed of 98,000 barrels of liquids and 301 million cubic feet of natural gas (a combined 36,000 barrels of oil-equivalent attributable to Chevron in 2020).

In the Mustang area, dozens of wells have been drilled using utility electric power since 2019. Facility design and electrification have removed produced water tanks, oil rejection tanks and burners, significantly reducing the surface footprint and greenhouse gas emissions.

California

In 2020, Chevron was one of the largest net daily oil-equivalent producers in California, with 104,000 barrels per day, composed of 102,000 barrels of crude oil and 12 million cubic feet of natural gas.

Most of the production is from Chevron-operated leases that are part of three major crude oil fields in the San Joaquin Valley – Kern River, Midway Sunset and Cymric. We also operate and hold interests in the McKittrick, San Ardo, Coalinga and Lost Hills fields. Our expertise in steamflood operations – which makes the oil flow more easily – has resulted in a crude oil recovery rate at the Kern River Field of more than 60 percent.

Chevron continues to leverage leading-edge heat management capabilities in the recovery of these hydrocarbons, with emphasis on improved energy efficiency through new technology and processes. A new 29-megawatt solar farm that is designed to supply 80 percent of the power needs at the Lost Hills Field went online in April 2020.

Pipeline

Our subsidiary Chevron Pipe Line Company transports crude oil, refined petroleum products, liquefied petroleum gas (LPG), natural gas, NGLs and chemicals within the United States. Chevron’s acquisition of Noble Midstream Partners LP included assets used in oil transportation, natural gas processing, gathering, treating and transportation in the DJ Basin in Colorado and Delaware Basin in Texas. In addition, the company operates pipelines for its 50 percent-owned Chevron Phillips Chemical affiliate. We also have direct and indirect interests in other U.S. and international pipelines.

In the U.S. Gulf of Mexico, Chevron completed and commissioned a 136-mile (219-km), 24-inch (61-cm) crude oil pipeline from the Jack/St. Malo deepwater production facility to a platform in Green Canyon Block 19 on the U.S. Gulf of Mexico shelf, where there is a connection to pipelines that deliver crude oil to Texas and Louisiana.

Shipping

Chevron Shipping Company LLC is based in San Ramon, California.

Our fleet uses a combination of single-voyage charters, short- and medium-term charters, and company-owned and bareboat-chartered vessels. Our fleet includes both U.S.- and foreign-flagged vessels. The U.S.-flagged vessels transport refined products, primarily in the coastal waters of the United States. The foreign-flagged vessels primarily transport crude oil, LNG, refined products and feedstocks to and from various locations worldwide. To support the company’s growing LNG portfolio, we added six new LNG carriers. Chevron also owns a one-sixth interest in each of seven LNG carriers that transport cargoes for the North West Shelf Venture in Australia.

Power generation

The Chevron Pipeline and Power business unit manages Chevron’s interest in our gas-fired and renewable power generation assets and provides comprehensive commercial, engineering and operational support services to improve the power reliability and energy efficiency of Chevron operations worldwide.

Gas-fired cogeneration facilities produce electricity and steam and use recovered waste heat to support enhanced oil recovery operations.

Our renewable operations consist of wind, geothermal and solar assets, including interests in geothermal and solar joint ventures in Arizona, California and Texas.

marketing and retail

Chevron manufactures and sells a range of high-quality refined products, including gasoline, diesel, marine and aviation fuels, premium base oil, finished lubricants, and fuel oil additives. We own five U.S. fuel refineries and have a network of Chevron® and Texaco® service stations.

Refining

Chevron has a crude refining capacity in the United States of approximately 1.0 million barrels per day. Refineries are in Richmond and El Segundo, California; North Salt Lake, Utah; Pasadena, Texas and Pascagoula, Mississippi.

Chevron continues to innovate to produce lower-carbon fuels, including Tier 3 gasoline, IMO lower-sulfur fuel oil, and renewable diesel blending at the El Segundo and Richmond Refineries. In addition, the El Segundo Refinery has modified key units to enable production of renewable fuels from biofeedstocks. At the North Salt Lake Refinery, construction continued in 2020 on the alkylation retrofit project, which is installing ISOALKY technology, a new process that reduces the overall environmental impact of motor gasoline.

Chevron became a leader in premium base oil production with the startup of the lubricant base-oil facility at the Pascagoula Refinery in 2014. We have another base oil plant at the Richmond Refinery.

Americas Products

Chevron’s fuel marketing efforts are managed by our Americas Products organization in the United States and Latin America, where the company has a network of more than 9,000 Chevron- and Texaco-branded retail outlets.

Chevron continues to leverage technology, incorporating its exclusive cleaning additive, Techron, into these markets in order to maintain a leading position in branded fuels. Chevron’s award-winning joint venture with Jacksons Food Stores, ExtraMile® Convenience Stores LLC, is the franchisor for 1,000 ExtraMile stores in the United States.

We are among the leading suppliers of jet and aviation fuels to commercial airlines, resellers and the military. Chevron markets aviation fuel at airports and terminals in the United States and supplies, through resellers, many general aviation locations.

Chevron also sells finished lubricants to commercial, industrial and retail customers nationwide. Our complete line of lubricant and coolant products includes our Chevron Havoline® and Chevron Delo® motor oils. These premium products help improve fuel economy, lower emissions and extend the period between oil changes.

At our Pascagoula Refinery in Mississippi, we have a 25,000-barrel-per-day premium base oil facility, which began operation in 2014. The $1.4 billion project made Chevron a leading producer of premium base oils.

Our lubricants business also is driving toward more sustainable practices through analysis of plant efficiency and supply chain opportunities. Several products are now being packaged based on bag-in-the-box concept that uses a minimum of 70 percent less plastic than the equivalent plastic bottles.

In addition, Chevron continues to invest in its California-based affiliate company that has developed innovative technology to produce high-performance base oils from renewable sources. Its plant in Deer Park, Texas, began first production of renewable base oil in August 2020. In 2021, Chevron launched the first Havoline renewable engine oil for passenger vehicles that demonstrates superior fuel economy improvement and retention properties made from renewable base oil.

supply and trading

Chevron’s Supply and Trading organization provides a critical link between Chevron’s Upstream and Downstream operations. Headquartered in Houston, Texas, with additional trading hubs in London, Singapore and San Ramon, California, it provides commercial support for crude oil and natural gas production operations and our refining and marketing network. The organization manages daily commodity transactions averaging 5 million barrels of liquids and 5 billion cubic feet of gas.

The Crude Supply and Trading group buys, sells and transports all major grades of crude oil and secures the best prices for selling Chevron’s Upstream production and for purchasing crudes used by our refineries.

The Product Supply and Trading group manages global supply, trading and logistics for feedstocks, fuels, and refined products like gasoline, naphtha, diesel, jet fuel, heavy fuels, biofuels, coke, sulfur, ammonia, asphalt and other products for the manufacturing and marketing network.

The Gas Supply and Trading (GSAT) group helps maximize the value of Chevron’s equity natural gas, LPG, NGLs and LNG globally. GSAT markets and manages transportation for Chevron’s equity natural gas production. It also manages all LPG and NGL trading, including supplying refineries and marketing NGLs produced by Chevron’s refineries and Upstream assets.

chemicals

Chevron is one of the world’s top producers of commodity petrochemicals, through the 50 percent-owned joint venture Chevron Phillips Chemical Company LLC (CPChem). Based in The Woodlands, Texas, CPChem manufactures building-block chemicals – olefins, polyolefins, aromatics, styrenics and specialty chemicals – used to make consumer and industrial products.

CPChem has a 51 percent interest in the U.S. Gulf Coast II Petrochemical Project. Plans call for a 2 million-metric-ton capacity ethylene cracker and two 1 million-metric-ton capacity high-density polyethylene units to be built in a location with direct access to the Permian Basin.

Oronite, a Chevron subsidiary headquartered in San Ramon, California, develops and manufactures fuel and lubricant additives and chemicals designed to enhance the performance of all types of transportation and industrial equipment. Additional facilities in the United States include:

- a technology center, in Richmond, California.

- a manufacturing plant, in Belle Chasse, Louisiana.

- the sales headquarters for the Americas region in Houston, Texas.

technology

Chevron has three technology companies that support the company’s businesses. The work that these companies do is integrated across Chevron. The groundbreaking technologies we are developing – many in the United States – are deployed throughout the company.

In the Permian Basin, Chevron deploys its proprietary technologies in exploration, resource characterization, well drilling and completion in operations at the company’s extensive unconventional resources. We developed proprietary modeling tools that use machine learning and artificial intelligence to optimize well spacing and completion design, leading to lower development costs. Our drilling assembly technology optimizes bit life and penetration rates using advanced modeling and analysis.

In the Gulf of Mexico, Chevron is using innovation and technology to increase production. In 2018, we upgraded the Jack and St. Malo seafloor boosting pumps, increasing production by approximately 20,000 barrels of crude oil per day. And we awarded contracts in 2018 for the design, construction and operation of a new offshore drilling unit capable of handling pressures of 20,000 psi for use in the Anchor Field.

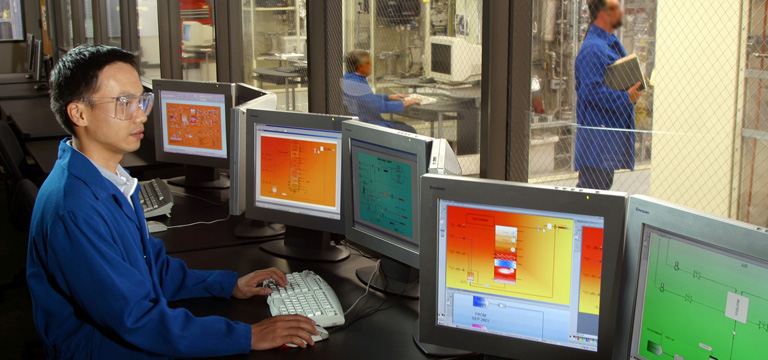

Our manufacturing sites are applying technology to improve reliability, increase asset productivity and optimize plant performance. We are leveraging advanced digital technologies that employ wireless connectivity, sensors, plant and process data analytics, and mobile worker solutions to improve safety, enhance equipment monitoring and reduce maintenance costs.

Focusing on the future of energy, Chevron continues to invest in breakthrough technologies by searching out new business solutions and innovative approaches. In 2018, we managed more than $350 million in venture capital investments and introduced or deployed more than 20 new technologies across the company. Chevron also launched the Future Energy Fund with an initial $100 million commitment targeted at reducing emissions. Among our investments are ChargePoint, an electric vehicle charging technology scaled for fleets and Natron Energy, a company developing stationary energy storage systems at electric vehicle charging stations.

in the community

Wherever Chevron operates, the company strives to build lasting relationships to create prosperity now and for decades to come. We contribute to the economic and social well-being of the communities where we operate by creating jobs, supporting local businesses and training the workforce of the future.

investing in education

Over the past three years, Chevron has invested more than $170 million in education partnerships and programs in the United States. We work with education organizations, government officials, nonprofit organizations and community leaders to create and strengthen education opportunities and offer career and technical training for students and workers. We invest in partnerships at every stage — from early education through employment — all with a special focus on cultivating programs in science, technology, engineering and math (STEM).

Chevron supports a broad range of programs across the United States:

- Chevron partners with the Fab Foundation to bring Fab Labs – fabrication laboratories – to areas where Chevron operates. The Fab Foundation provides access to tools and technology to educate, innovate and invent. The first Chevron-sponsored Fab Lab opened in 2014 at California State University, Bakersfield. Since then, Fab Labs have been added in Richmond, California; Pittsburgh and Grindstone, Pennsylvania; and Washington, D.C. In 2017, Chevron partnered with Odessa College to open Fab Lab Permian Basin. The on-campus facility is the first Chevron-sponsored Fab Lab in Texas. Fab Labs are open both to students and to the community.

- Chevron supports Project SEED as part of our commitment to preparing students for careers in engineering, research and technology. This nine-week internship offers high school students in Richmond the chance to learn about science by working in a laboratory setting, which includes the labs at our Chevron Richmond Technology Center campus.

- With Chevron’s help, Project Lead the Way (PLTW) has brought rigorous, project-based engineering curricula to 40,000 students in more than 100 schools in California, Louisiana, Mississippi, Ohio, Pennsylvania, Texas, Utah and West Virginia. Chevron was the first corporation to support PLTW’s National Grow Campaign, with a $6 million pledge in 2013.

- Fuel Your School is an innovative collaboration with DonorsChoose.org that makes it easy for people to help public school teachers obtain classroom resources.

- The mission of Techbridge is to inspire girls to discover a passion for technology, science and engineering through hands-on learning. Techbridge empowers the next generation of female innovators and leaders.

- Chevron supports the Robotics Academy, the Summer Robotics Camp and the Aquatic Robotics Summer Camp. These Gulf Coast programs give students the opportunity to build working robots while honing their STEM skills.

- Chevron is a sponsor of the Richmond High School Robotics Program. Students in the program learn critical life and work-related skills by working side by side with professionals who mentor the students through the process of building a robot for the FIRST (For Inspiration and Recognition of Science and Technology) Robotics Competition.

- JASON Learning is a national nonprofit program that inspires students to pursue careers in STEM fields through award-winning curricula developed with the National Geographic Society and the National Oceanic and Atmospheric Administration. Chevron funds the project in 10 Houston-area school districts, where more than 1,000 teachers have received professional development training. More than 135,000 students participate in the program.

improving career and technical training

Chevron supports career and technical training programs that provide a foundation for long-term economic development.

In partnership with Casa de Amigos, Chevron supports the Take2 job skills program in the Permian Basin. The program helps equip low-income women and men with the skills to obtain high-paying jobs. In 2016, the program offered training to 184 people.

Among several Gulf Coast initiatives, Chevron partnered with GNO, Inc., and Delgado Community College to use the annual Technical Skills Expo to introduce more than 800 high school students to industry opportunities, career pathways and training available at their schools. Chevron also helped create curricula for workforce development programs at Mississippi Gulf Coast Community College. Since those programs began, our Pascagoula Refinery has hired 134 graduates.

Chevron funds the Contra Costa County Office of Education’s Regional Occupational Program (ROP). This program offers courses that provide free job training and equip residents with the skills to compete for well-paying jobs, including technical jobs at the Richmond Refinery. ROP courses help students develop strong communication skills, strengthen their analytical skills, and learn how to work productively, both independently and as part of a team.

For more than a dozen years, our Richmond Refinery has supported RichmondBUILD, a pre-apprenticeship program focused on developing talent and skill in the high-growth, high-wage construction and renewable energy fields. All RichmondBUILD participants come from low-income households in the local community and graduate with an industry-recognized certificate.

Our Salt Lake Refinery teams with the Utah Office of Energy Development to award scholarships to high school students who plan to enroll in-state at technical colleges to pursue trade careers of importance to the oil and gas industry.

record of achievement

Chevron’s story dates back to an 1876 oil discovery at Pico Canyon in the Santa Susana Mountains, north of Los Angeles. The find led to the 1879 formation of Chevron’s earliest predecessor, the Pacific Coast Oil Co.

Another part of our history begins with the 1901 founding of The Texas Fuel Co. (later Texaco) and its historic oil discovery two years later at Sour Lake, Texas. These companies and other members of the Chevron family have been instrumental in transforming the oil business into today’s global energy industry.

Throughout the 20th century, Chevron and Texaco experienced dynamic growth in the United States and internationally. In 1984, Standard Oil Co. of California, Chevron’s immediate predecessor, acquired Gulf Corporation in a $13.3 billion merger. At the time, it was the largest acquisition in corporate history. That same year, Texaco purchased Getty Oil and gained 1.9 billion barrels in proved reserves of crude oil and 2.8 trillion cubic feet of natural gas reserves.

Chevron and Texaco formed a number of partnerships, most notably Caltex Corp. in 1936. The 2001 merger of Chevron and Texaco was a natural outgrowth of a successful history of teamwork. In 2005, Chevron acquired Unocal Corp. In 2011, we acquired Atlas Energy, Inc., which added natural gas resources and shale acreage, primarily in southwestern Pennsylvania and northern Michigan.

health and safety

Chevron continues to demonstrate its commitment to advancing health initiatives, protecting the environment and promoting safety. We use our Operational Excellence Management System to systematically drive continuous improvement throughout our organization.

We are instituting a standard Contractor Health and Safety Management process across the company to help ensure that workers can do their jobs without risk to themselves, others or the environment and to help contract workers be aware of the safe work practices that apply to the work they are doing. For example, our San Joaquin Valley Upstream business unit works with key contractors to raise their awareness about safeguards to prevent and mitigate incidents.

Chevron was selected as the Best of the Best among the 2014 IHS SPECTRUM Excellence Award winners based on our innovative use of information systems to achieve environmental, health, safety and sustainability business goals.

In addition, our Piceance Basin operation, in northwestern Colorado, has initiated a multiyear research study of wildlife and habitat conducted by Colorado State University’s Warner College of Natural Resources.

In 2015, the Center for Offshore Safety awarded Chevron North America Exploration and Production its Safety Leadership Award in recognition of the Greater Gulf of Mexico’s Field Competency Program. Chevron was the only operator to receive the award, which recognizes outstanding contributions by an operator to improving safety management and sharing that knowledge with the industry.

In 2016, the American Petroleum Institute honored Chevron Pipe Line Company with the Distinguished Safety and Environmental Award for large operators, the organization’s highest safety and environmental performance award for pipeline operators.

contact

Chevron Headquarters

6001 Bollinger Canyon Rd.

San Ramon, CA 94583, U.S.A.

Telephone: +1 925.842.1000

Send an Email

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER IMPORTANT LEGAL DISCLAIMERS

This website contains forward-looking images and statements relating to Chevron’s operations and lower carbon strategy that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,” “projects,” “believes,” “approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “progress,” “may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential,” “ambitions,” “aspires” and similar expressions, and variations or negatives of these words, are intended to identify such forward-looking statements, but not all forward-looking statements include such words. These statements are not guarantees of future performance and are subject to numerous risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Our ability to achieve any aspiration, target or objective outlined in this report is subject to numerous risks, many of which are outside of our control. Examples of such risks include: (1) sufficient and substantial advances in technology, including the continuing progress of commercially viable technologies and low- or non-carbon-based energy sources; (2) laws, governmental regulation, policies, and other enabling actions, including the granting of necessary permits by governing authorities; (3) the availability and acceptability of cost-effective, verifiable carbon credits; (4) the availability of suppliers that can meet our sustainability-related standards; (5) evolving regulatory requirements, including changes to IPCC’s Global Warming Potentials, affecting ESG standards or disclosures; (6) evolving standards for tracking and reporting on emissions and emissions reductions and removals; (7) customers’ and consumers’ preferences and use of the company’s products or substitute products; (8) actions taken by the company’s competitors in response to legislation and regulations; and (9) successful negotiations for carbon capture and storage and nature-based solutions. Further, standards of measurement and performance set forth in this report made in reference to our environmental, social, governance, and other sustainability plans and goals may be based on protocols, processes and assumptions that continue to evolve and are subject to change in the future, including due to the impact of future regulation. The reader should not place undue reliance on these forward-looking statements. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for the company’s products, and production curtailments due to market conditions; crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; technological advancements; changes to government policies in the countries in which the company operates; public health crises, such as pandemics and epidemics, and any related government policies and actions; disruptions in the company’s global supply chain, including supply chain constraints and escalation of the cost of goods and services; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic, market and political conditions, including the military conflict between Russia and Ukraine, the war between Israel and Hamas and the global response to these hostilities; changing refining, marketing and chemicals margins; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; development of large carbon capture and offset markets; the results of operations and financial condition of the company’s suppliers, vendors, partners and equity affiliates; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes undertaken or required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures related to greenhouse gas emissions and climate change; the potential liability resulting from pending or future litigation; the ability to successfully integrate the operations of the company and PDC Energy, Inc. and achieve the anticipated benefits from the transaction, including the expected incremental annual free cash flow; the risk that Hess Corporation (Hess) stockholders do not approve the potential transaction, and the risk that regulatory approvals are not obtained or are obtained subject to conditions that are not anticipated by the company and Hess; potential delays in consummating the transaction, including as a result of regulatory proceedings or the ongoing arbitration proceedings regarding preemptive rights in the Stabroek Block joint operating agreement; risks that such ongoing arbitration is not satisfactorily resolved and the potential transaction fails to be consummated; uncertainties as to whether the potential transaction, if consummated, will achieve its anticipated economic benefits, including as a result of regulatory proceedings and risks associated with third party contracts containing material consent, anti-assignment, transfer or other provisions that may be related to the potential transaction that are not waived or otherwise satisfactorily resolved; the company’s ability to integrate Hess’ operations in a successful manner and in the expected time period; the possibility that any of the anticipated benefits and projected synergies of the potential transaction will not be realized or will not be realized within the expected time period; the company’s future acquisitions or dispositions of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, taxes and tax audits, tariffs, sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; higher inflation and related impacts; material reductions in corporate liquidity and access to debt markets; changes to the company’s capital allocation strategies; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 20 through 26 of the company’s 2023 Annual Report on Form 10-K and in subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed on this website could also have material adverse effects on forward-looking statements.

For the latest figures, view the 2023 Supplement to the Annual Report.

chevron email updates

Subscribe to our newsletter to receive news and updates.

downloads

- 2023 Annual Report pdf opens in new window

- 2022 Corporate Sustainability Report pdf opens in new window

- The Chevron Way – English pdf opens in new window

- 2023 Climate Change Resilience Report pdf opens in new window

- 2023 Supplement to the Annual Report pdf opens in new window