our operations

chevron exec: california policy would deter energy production

11 min read | january 08, 2024

Last month, Andy Walz sent a letter to the California Energy Commission to provide context on how a new policy would impact the state’s energy production.

A Chevron executive is calling on the California Energy Commission to reject a policy that would limit energy investment in the state.

Andy Walz, president of Chevron Americas Products, said in a letter to the commission that California’s Senate Bill (SB) X1-2 would deter investment in the region’s energy market.

5 things to know:

- Chevron’s letter to the California Energy Commission: SB X1-2 would worsen the supply-and-demand imbalances and increase gasoline prices in the state.

- California’s gas price contributors: Government policies, crude oil costs, geography, and taxes and fees are some of the top factors influencing the state’s gasoline prices.

- Chevron’s stance on California investments: California’s policies have made it a difficult place to invest, prompting spending cuts and canceled projects.

- Chevron’s recommendation: California should shift from a policy that disincentivizes production and toward one that incentivizes investment and innovation.

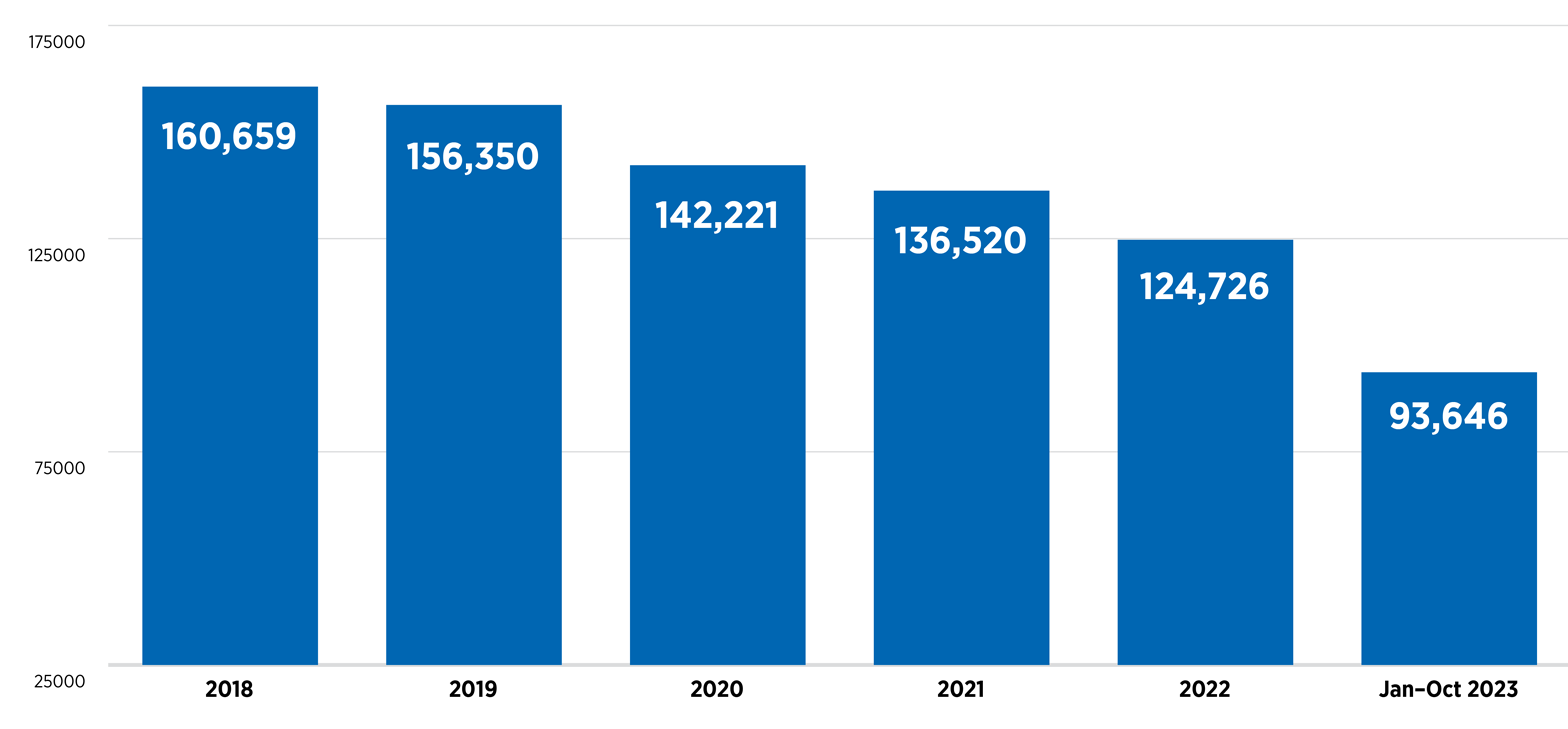

- Production drop: California’s oil and gas production has dropped approximately 29% in the last six years.

California field production of crude oil

thousand barrels

letter to the california energy commission

Thank you for the opportunity to comment on the impact of a potential maximum gross gasoline refining margin and penalty per Senate Bill (SB) X1-2 (2023), referred to herein as “margin penalty,” and supply-and-demand imbalances, gasoline prices, and the transportation-fuels market generally. Chevron has a unique perspective on California’s transportation-fuels market. We are one of the original oil producers in the state, and we have the most extensive business here, from wellheads to retail storefronts. We appreciate the opportunity to share this perspective.

Chevron’s El Segundo Refinery in California is the largest producing oil refinery on the West Coast.

Chevron believes energy must be affordable, reliable, and ever cleaner to enable human progress. That is why we have invested billions of dollars in creating new, lower-carbon energy sources to help meet California’s growing demand for affordable and reliable energy.1 Chevron is proud of our progress in lowering the carbon intensity of our products and operations. It is with these goals in mind that Chevron writes to provide context for the California Energy Commission’s (CEC) decision regarding whether to impose a gross gasoline refining margin penalty under SBX1-2. Unfortunately, the distortive effects of such a policy would likely run counter to the goal of ensuring that gasoline remains affordable and reliable, in addition to ever cleaner.

Rather than solving supply challenges or enabling increased production of clean, affordable gasoline, a margin penalty would contribute to a decades-long trend of decreasing investment and tightening supply. Since the 1980s, dozens of refineries have closed due to an increasingly harsh regulatory environment, which has resulted in increased gasoline price volatility and reduced production. A margin penalty will only exacerbate this troubling trend.

how does policy impact gasoline prices?

In determining the likely impact of a potential margin penalty, the CEC should consider the factors that drive gasoline prices in California, including government policies at the downstream (refining and retail), midstream (pipelines and shipping), and upstream levels (crude oil and natural gas production); crude oil prices; geography; and taxes and fees. A margin penalty addresses none of those factors and will likely only worsen supply and demand imbalances and, in turn, increase gasoline prices.

As in any industry, retail gasoline prices are determined by supply, demand, and governmental policy. Supply and demand generally work like in any other market – more demand or less supply equals higher prices, and the converse is also true. And in most other markets, supply and demand adjust to quickly resolve market disruptions; for example, suppliers would typically increase production to meet demand during price spikes. But in the California gasoline market, increasingly burdensome government policies, passed with the stated aim of reducing gasoline supply, have driven a wedge between supply and demand.

This trend began more than 25 years ago, when, in 1995, the state implemented its unprecedented California Air Resource Board Phase 2 Gasoline Formulation Mandate (California Cleaner Burning Gasoline), setting the course for the state to become a “fuel island.” The goal of these policies has always been to phase out gasoline, including by increasing gasoline prices. Indeed, then-California Senate Leader Darrell Steinberg said during negotiations around AB 32, the “Global Warming Solutions Act of 2006”: “Under either a carbon tax or cap and trade applied to fuel, consumers will pay more at the pump. That’s necessary. Higher prices discourage demand. If carbon pricing doesn’t sting, we won’t change our habits.” 2 And in 2022, California’s Air Resources Board approved a plan to cut liquid petroleum fuels 90% by 2045 – only achievable with extraordinary and aggressive interventions that will cause consumer prices to rise.3

In short, two decades of policy choices have reduced supply elasticity and severely limited refiners’ ability to react to higher prices. Every day, California consumes more than 60 million gallons of crude oil4 and Californians drove more this year in October than in any previous October. The same for September and August. Demand for oil derived products remains robust. But the manufacturing capacity to refine that crude oil into useful products like gasoline, diesel, and jet fuel continues to tighten. California’s policies not only have neglected to respond to the increasing supply-and-demand imbalances—they have worsened them.

The policies that impact gasoline prices are not just refining-related, however. Onerous permitting restrictions for crude production or energy infrastructure and costs associated with California’s unique environmental policies all reduce supply or raise the cost of production. The state has long pursued a set of policies to reduce demand, increasing gasoline prices to change consumer behavior. California has used all these policy levers simultaneously in a manner that has raised retail costs for gasoline.

The CEC in September 2022 reported that the primary influence on gasoline prices is the global price of crude oil – the main input for gasoline, diesel, and jet fuel production.5 Markets for crude oil are some of the most liquid and transparent in the world and rise or fall based on global demand changes, geopolitical risk, and policy decisions by oil-exporting countries. Demand for energy is largely inelastic because energy is essential to modern life. Energy is required for just about everything we do. That demand elasticity, coupled with global price shocks, can cause prices to rise quickly and stay elevated.

Geography is also a significant driver of price volatility. The West Coast is an energy island, cut off from supply in the rest of the United States, without pipeline infrastructure to receive products from the Gulf Coast. The Jones Act restricts shipping between the Gulf Coast and California, complicating and limiting domestic, ocean-borne tanker routes. The supplier of the next resort – the next-best choice – is the Asia-Pacific seaborne market. The requirement for a unique California blend of gasoline adds to this isolation. Especially in the summer, this blend is expensive and requires specific equipment to produce, costs which are passed along to California drivers. These supply challenges, plus the resulting delays and shipping time, further constrain the supply of imported gasoline.

The CEC rounded out its analysis of why California gasoline prices are so high by noting the costs of taxes and fees. Californians pay over $1 per gallon in taxes, fees, and costs associated with environmental programs every time they fill up. CEC data for 2022 shows average gasoline state taxes were $0.66 per gallon with an additional $0.49 for “environmental fees” bringing the total to $1.15.6 This was over 3.7 times higher than the national average state tax of $0.31 in 2022.7

A margin penalty will not resolve upstream, midstream, or downstream policies that create supply restrictions. Nor would a margin penalty ease crude oil prices, geographical challenges, or high taxes and fees. Instead, it will only serve to drive supply and demand further apart by disincentivizing investment and distorting the price signals that help resolve supply disruptions.

In particular, a margin penalty can only serve to further deter investment in the state’s energy market. This is not hyperbole, nor is it merely hypothetical. California’s policies have made Chevron’s investments in its home state riskier than investing in other states, with projects being lower in quality and higher in cost. Chevron alone has reduced spending in California by hundreds of millions of dollars since 2022 –California’s policies have made it a difficult place to invest so we have rejected capital projects in the state. Such capital flight reflects the state’s inadequate returns and adversarial business climate.

The CEC and the Legislature have yet to articulate a theory for how a margin penalty can solve any of the challenges that all stakeholders agree face the California transportation-fuels market. Until and unless it can do so, the CEC should refrain from adopting a policy that can only exacerbate those challenges.

margin penalty and other production disincentives

Policies that intentionally handicap the energy industry, such as a potential margin penalty, can have a direct impact on consumers because they may reduce the incentive to invest and thus decrease supply. The state has dampened price spikes in middle distillates by incentivizing renewable diesel, jet fuel, and kerosene, but has not engaged in similar work to increase gasoline supplies – and in the absence of those supply buffers, tight supplies have led to significant price spikes, while regulations make investment here perilous. Projects by in-state refiners would help increase affordable, reliable, safe, and equitable access to fuel, but state policies disincentivize these projects.

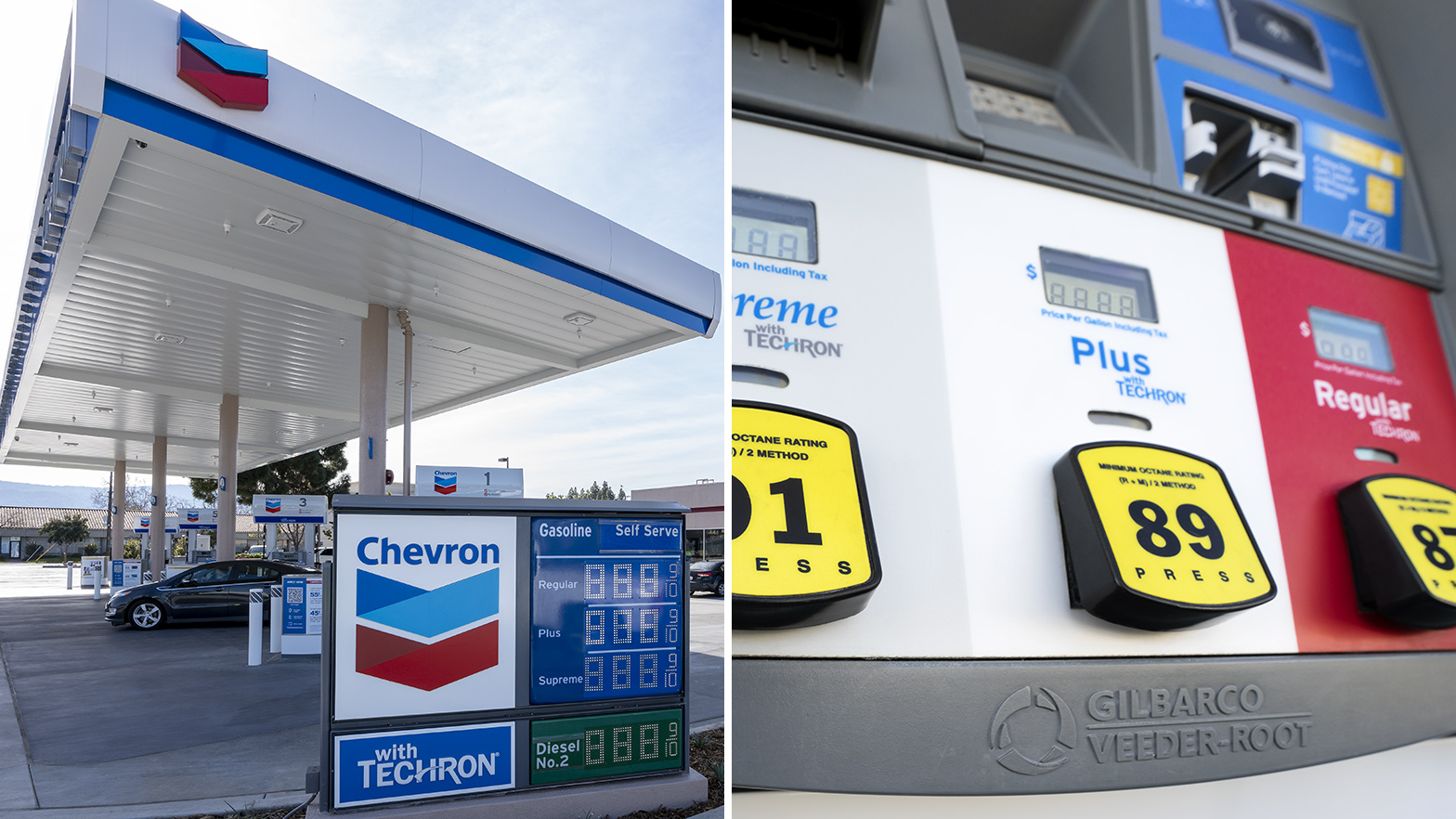

Gas station and fuel dispenser in Mountain View, California.

how does investment impact gasoline prices?

Overall investment in the oil and gas industry can impact gasoline prices through a complex system that involves various interdependent components. Increased investment in exploration, extraction and production technologies can potentially lead to higher oil supplies, providing reliable supply of oil helping to stabilize or lower prices. Investment in infrastructure used to safely transport both the oil used in gasoline production and the finished products themselves provides affordable and reliable methods which can reduce the cost of getting gasoline to the pump. Investment into tankage can provide additional flexibility when uncertainty occurs in this complex network. Conversely, lower investment reduces supply and contributes to more volatility and higher prices.

Storage tanks at the El Segundo Refinery in California, which produces biofuels such as a renewable diesel blend.

Importantly, investments in alternative energy sources and technologies can help diversify and influence the overall energy market. At Chevron, we believe in an “all-of-the-above” approach is needed to lower carbon energy solutions. Battery and hydrogen fuel-cell powered electric vehicles are a part of the solution. However, we also believe that with the right policy support, investment can be made in affordable alternatives while reducing emissions from vehicles on the road by using existing technology and infrastructure.8

how does policy impact investments into renewables?

A margin penalty will not only decrease investment in gasoline; by creating uncertainty in the energy markets, it will decrease overall investment by energy companies in California, including and especially in renewable energy. Poorly designed policies have created uncertainty in businesses’ confidence in in-state investments, leading to reluctance to commit funds to long-term renewable energy projects. Chevron has been fueling California for more than 140 years, and we continue to be leaders in transportation engineering and research. But policies like a margin penalty create uncertainty across its business model (from early-stage investments in clean energy to delivering consumer-ready gasoline across the state) and prevent it from contributing that leadership across all its segments, including renewable investments.

The 220-acre solar field at the Lost Hills facility in San Joaquin Valley will produce lower carbon hydrogen and provide electricity to the existing oil field in Kern County, California.

Chevron leverages our strengths to safely deliver lower-carbon energy to a growing world. We aim to lead in lower carbon intensity oil, products, and natural gas, and advance new solutions to reduce carbon emissions of major industries. We have committed to spending $2 billion in carbon reduction projects from our existing businesses and another $8 billion in lower carbon investments by 2028. And in 2021, Chevron announced our intention to grow our renewable fuels production capacity to 100,000 barrels per day by 2030.9

Workers climbing up stairs to the top of two stage tanks at a Chevron Renewable Energy Group biorefinery.

With our biofuels projects at El Segundo Refinery and our acquisition of Renewable Energy Group (REG) in 2022, we are approximately halfway to that goal. However, we are facing challenges meeting that goal with investments in California. In the past year, we have canceled several projects due to permitting challenges. Uncertainty with the potential imposition of a margin penalty on our refineries would impact our ability to fund similar renewable energy projects.

how can California help lower cost of fueling?

Chevron believes in lower-carbon solutions and projects and hopes to contribute to a more balanced conversation about the state’s energy future. To make progress toward that future, California should shift away from a policy platform that disincentivizes production of affordable, reliable, and ever-cleaner energy and toward one that is more pragmatic, incentivizes investment and innovation, and recognizes challenges of scale and the need for diverse solutions. Industry participants can make voluntary lower carbon investments but can only do so in a policy environment that supports and encourages those investments.

Chevron is working on the next generation of breakthrough technologies to deliver energy solutions, such as renewable base oil and renewable lubricant, at the blend services laboratory at the Richmond Refinery Technology Center in California.

In conclusion, while the margin penalty may have been proposed with the best intentions, it will reduce investment by suppliers and hurt consumers. The price spikes and market volatility symptomatic of tight gasoline supply will only get worse – this disincentive to California manufacturing will make them more frequent and more disruptive. By considering a margin penalty, the state is signaling its hostility to energy investment. Setting a margin penalty would absolutely discourage investments here. Further, these arbitrary attacks on a disfavored industry do more than this – they signal to every industry, entrepreneur, manufacturer, and employer that California is closed for business.

Thank you for providing this opportunity to comment. If you have any questions regarding our comments, please contact Henry Perea at (Henry.Perea@Chevron.com), or Jennifer Reed (Jennifer.Reed@Chevron.com).

Sincerely,

Andy Walz

President, Products

references

1 For more information, see Chevron’s 2022 Corporate Sustainability Report at Chevron.com/Sustainability

2 Marc Lifisher, State Senate Leader Proposes ‘Carbon Tax’ on Motor Vehicle Fuels, Los Angeles Times, Feb. 20, 2014 at https://www.latimes.com/business/la-fi-carbon-tax-proposal-20140221-story.html

3 California Air Resources Board, 2022 Scoping Plan 2022 Scoping Plan Documents | California Air Resources Board

4 U.S. Energy Information Administration 2023, EIA California Profile last updated April 2023. Retrieved December 5, 2023 from California Profile (eia.gov)

5 California Energy Commission, What Drives California’s Gasoline Prices? (September 2022), https://www.energy.ca.gov/data-reports/energy-insights/what-drives-californias-gasoline-prices.

6 California Energy Commission 2023. California Energy Commission Estimated Gasoline Price Breakdown and Margins Data last updated December 7, 2023. Retrieved December 12, 2023 from [Estimated Gasoline Price Breakdown and Margins (ca.gov)].

7 Average Total State for Gasoline U.S. Energy Information Administration 2023, EIA last updated July 2023. Retrieved December 12, 2023 from https://www.eia.gov/petroleum/marketing/monthly/xls/fueltaxes.xlsx

8 Docket ID No. EPA-HQ-OAR-2022-0829, Chevron Comment Letter in response to Proposed Rule: Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles. Available here: Regulations.gov

9 For more information, see Chevron’s 2022 Corporate Sustainability Report at Chevron.com/Sustainability

topics covered

related content

chevron email updates

Subscribe to our newsletter to receive news and updates.