shale and tight resources

natural gas and crude oil from shale and tight rock formations are changing the global energy supply landscape

Globally, there are more than 7,500 trillion cubic feet of technically recoverable shale gas resources.

There are over 400 billion barrels of shale/tight oil in the world

The amount of recoverable shale gas available is equivalent to about 60 years of the world's current natural gas demand.

where we operate

United States

In the Permian region (Texas and New Mexico), Chevron holds approximately 1.8 million net acres (7,284 sq km) in the Delaware and Midland basins, where it is developing tight oil and liquids-rich gas shales.

The company also holds shale and tight resource opportunities elsewhere in the midcontinent region, primarily in East Texas and in the Piceance Basin in northwestern Colorado.

Chevron has 327,000 net acres (1,323 sq km) in Colorado’s Denver-Julesburg (DJ) Basin, focusing development in two key areas: Wells Ranch and Mustang. Development incorporating integrated pipeline infrastructure in the Mustang area improves both cycle times and capital efficiency.

Argentina

In Argentina, Chevron produces crude oil and natural gas through its wholly owned subsidiary Chevron Argentina S.R.L. The company’s interests include exploration for and development of shale oil and gas resources from the Vaca Muerta formation in Neuquén province. Chevron Argentina S.R.L. owns and operates one concession, covering 111,000 net acres (450 sq km), that has both conventional production and Vaca Muerta Shale potential. Also in the Vaca Muerta shale formation, another Chevron subsidiary participates in the Loma Campana and Narambuena concessions, covering 73,000 net acres (295 sq km).

how we operate

Development of natural gas and oil resources from shale and tight rock involves a number of steps. These include obtaining permission to drill from the landowner and government, constructing a temporary drilling site, and using a rig to drill the well. A key aspect of releasing the resources from the rock formations is the use of hydraulic fracturing (commonly known as "fracking"), which involves injecting water, sand and a small amount of chemical additives under pressure to crack the rock and release the trapped oil and gas. By combining this process with horizontal drilling, more of the resource can be reached with fewer wells and less earth disturbance. Once drilling and completions processes are complete, the well is ready to produce oil or natural gas or both for decades. Chevron monitors the well throughout its life to verify integrity and when the well stops producing, the land is restored to its natural state. Similar activities occur in producing shale gas and tight oil from other Chevron operations, including the Permian Basin.

industry leader

In 2014, Chevron became the first company to earn Center for Responsible Shale Development certification, which recognizes our environmentally sound practices. The CRSD is an unprecedented collaboration built on constructive engagement among environmental organizations, philanthropic foundations and energy companies who share the objective of advancing the industry’s operational performance through technological innovation and the sharing of best practices. Chevron was recertified in October 2016.

technology

Technology is essential to identifying, developing and producing shale reservoirs. We have a technology unit focused exclusively on solving the technical challenges of shale and tight rock formations.

shale technology

addressing the issues

Keeping people safe and protecting the environment are Chevron core values. We share the public's expectation that the energy we need will be produced safely and reliably. Decisions for all our shale and tight oil and gas operations are guided by Chevron’s Operational Excellence Management System, a systematic and risk-based approach to identifying, assessing and managing personal safety and health, process safety, the environment, reliability and efficiency. We employ a systematic approach to environmental stewardship that includes rigorous standards and processes. We know that public confidence in our operations is essential to our success. We engage communities where we live and operate to learn about local concerns, share information and minimize potential impacts of our activities.

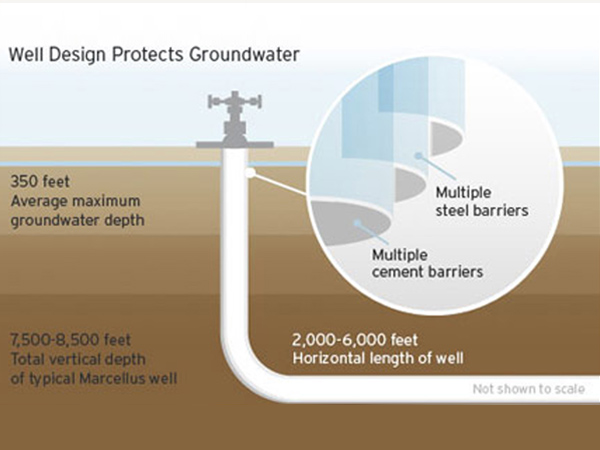

We take steps to protect groundwater during hydraulic fracturing and over the life of the well. Our wells have multiple layers of steel casing and cement that form a continuous barrier between the well and the surrounding formations. We perform pressure tests to ensure the well’s integrity, and conduct monitoring and various tests over the life of the well, which may include cement evaluation logs, temperature, acoustic or ultrasonic measures, to verify long-term integrity. Because fracturing is done thousands of feet beneath the groundwater aquifer, the potential for cracks to leak gas or fracturing fluids into groundwater is extremely low. For example, micro-seismic surveys of shale gas wells in the eastern United States show that fractures are separated from groundwater by more than a mile of rock - a distance as deep as the Grand Canyon.

We use pre-drilling and planning activities to identify areas of potential environmental, geologic or archaeological sensitivity. Such activities may include assessing the subsurface geology to identify and mitigate risks associated with groundwater aquifers, faults and geological pathways, historical wells in the area and shallow gas reservoirs.

Fresh water is a precious resource. Chevron is committed to responsible water use and strives to reduce the amount of fresh water used in our hydraulic fracturing operations. In the Permian Basin, we are endeavoring to use deeper aquifers that contain brackish water not suitable for human consumption or agricultural usage. During hydraulic fracturing, we have the capability to recycle nearly 100 percent of our flowback and produced water.

We are committed to protecting air quality by reducing emissions from our shale and tight oil and gas operations. We design and construct our wells to operate reliably and minimize emissions. We verify and maintain asset integrity through regular inspection and maintenance programs.

Chevron and the industry have worked for years with governments and other stakeholders to develop programs that encourage the industry to reduce natural gas leaks and improve operational efficiencies. Learn more about what Chevron is doing to manage emissions.

Hydraulic fracturing has been in use since the 1940s. Today, nearly half the oil produced in the U.S. and two-thirds of U.S. natural gas production comes from wells that have undergone hydraulic fracturing. Water and sand constitute more than 99 percent of fracturing fluid. The remaining 1 percent consists of a small number of chemicals added to improve the efficiency and effectiveness of fracturing. Some of these same substances can also be found in food and beverages.

We support giving the public access to information related to chemicals used in hydraulic fracturing. Chevron discloses vendor-provided information concerning the chemicals used in its hydraulically fractured wells in the United States at FracFocus.org and in Canada at www.FracFocus.ca. Safety Data Sheet level-only information is provided to Frac Focus. Some Frac Focus reports may exclude chemical ingredients that are considered proprietary by the vendors supplying them. In addition, Chevron complies with all laws that require disclosure and reporting to specific governmental agency databases.

We are committed to safely and responsibly managing fracturing fluids, flowback and produced water. After the hydraulic fracturing process is complete and the well begins to produce natural gas or oil, a portion of the water used during the fracturing process flows back to the surface. This water is stored temporarily in lined pits or steel tanks until it is either recycled, reused in future fracturing jobs or injected into disposal wells permitted and regulated for that purpose.

Naturally occurring radioactive material (NORM) is found in some subsurface formations, and may be brought to the surface during drilling and production operations. When Chevron encounters NORM, we take steps to measure, track and dispose of it responsibly, in compliance with applicable regulations.

Induced seismicity has long been a low, but recognized risk of underground fluid disposal wells, one of the ways that the oil and gas industry disposes of produced water, which is the water that is brought to the surface when extracting oil and natural gas. When properly planned, operated, and monitored, fluid disposal wells are safe. In the U.S., these wells have been used since the 1930s and are regulated by the U.S. EPA and states.

The possibility of hydraulic fracturing causing induced seismic events felt at the earth’s surface is rare. Energy from the process is usually not sufficiently large enough to cause such an occurrence, according to reports by the U.S. Geological Survey, National Academy of Sciences and the American Association of Petroleum Geologists. Experts at these organizations concluded that any micro-seismic events from hydraulic fracturing are generally too small to present safety concerns.

Where appropriate, we closely monitor our operations using technologies such as acoustic sensors, tracers, and seismic monitoring networks to validate our well design parameters. Additionally, Chevron is working with academic institutions, including the Stanford Center for Induced and Triggered Seismicity, the Texas Bureau of Economic Geology Center for Integrated Seismicity Research and the University of Calgary, to improve our understanding of induced seismicity and to identify ways to reduce potential risks.

For the latest figures, view the 2024 Supplement to the Annual Report.